|

[Editorial Note: Due to circumstances beyond the Energy Office's control, not all energy production, cost and consumption information for 1998 was available by the deadline for the publication of this report.]

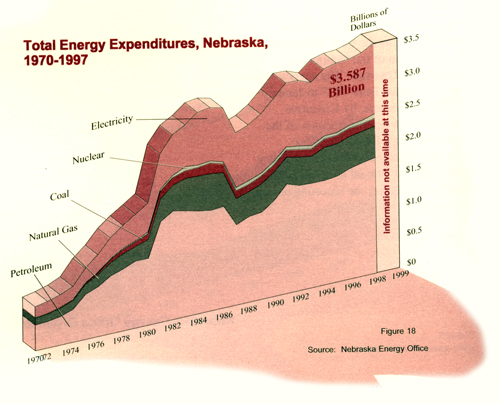

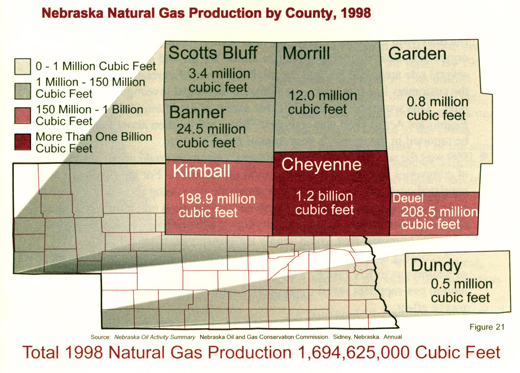

Nebraska's total energy bill topped $3.5 billion - exactly 3.587 billion in 1997. This was the highest amount ever, surpassing the previous year's $3.456 billion.

The cost of the state's petroleum dependence remained unchanged. A little over half of all energy expenditures - 52.5 percent in 1997 - were for petroleum and its refined products used in the state. Nebraska's petroleum bill for 1997 totaled $1.884 billion.

Energy consumption in terms of British thermal units (BTUs) rose from 580 trillion in 1995 to 630 trillion in 1996 to 705 trillion in 1997. Since 1990 Nebraska's total energy use in terms of BTUs rose more than 37 percent. In dollar terms, the amount Nebraskans spend on energy rose more than 15 percent from 1990 to 1997.

Looking at energy use by sector of the Nebraska economy, it is clear that the increase in energy use cut across all sectors - residential, commercial, industrial (including agriculture) and transportation.

The residential sector saw its cost for energy rise from $653.3 million in 1990 to $738.9 million in 1995 to $782.4 million in 1997. Hence, there was about a 20 percent increase in the total money spent by the residential sector on energy from 1990 to 1997.

Based on the Energy Information Agency's 1997 Residential Energy Consumption Survey, the average American household spent $1,338 on energy in 1997. However in the Midwest household, energy costs were higher - $1,396, primarily due to space heating. According to the Information Agency, Nebraskans are close to the national average in per capita use of energy using 372 million British thermal units per person, 21 million British thermal units more than the national average.

Typically, half the energy used in homes was for space heating. Twenty-two percent was used for appliances, including refrigeration. In the past 20 years, average per household energy consumption was 27 percent lower in 1997 than in 1978. The largest percentage decline in energy use was related to space heating. Since 1978, many homeowners have replaced heating systems with more efficient ones attributing to the marked decline.

In the commercial sector, more than $611 million was expended on energy in 1997. This value represents about an 11 percent increase over the amount expended in 1990.

The industrial sector (including agriculture) expended a total of $653.8 million on energy in 1997. This value represents a 15 percent increase over the sector's 1990 expenditures and a six percent increase of its 1995 expenditures.

By far, the transportation sector consumes the most energy dollars in Nebraska - a total of $1.54 billion in 1997. Its 1997 value is 14 percent higher than its 1990 value and seven percent higher than its 1995 value.

For the most part, Nebraska as a state pays less for energy than other states. Nebraska's total energy prices rank 32nd among U.S. states. Nebraska's electricity prices rank 40th, compared to 23rd for Kansas, 27th for Colorado and 39th for Iowa. Per person, however, Nebraska ranks slightly above average for energy prices at 21st, compared to 19th for Kansas, 48th for Colorado, and 29th for Iowa. Natural gas prices in Nebraska rank 35th, compared to 44th for Kansas, 32nd for Colorado, and 31st for Iowa. Nebraska's electricity prices are among the lowest in the nation. Compared to other states, Nebraska's electricity prices rank 40th, while prices in Kansas at 23rd, Colorado at 30th and Iowa at 33rd rank higher.

State Production and Consumption

In 1997, energy use by the state's electric utilities surpassed 304 trillion British thermal units, a new record and an increase of 3.7 percent over the 1996 total of 293.3 trillion British thermal units, also a record. Data on Nebraskans' expenditures for electricity for 1996 and 1997 was not available at the time of publication.

Electricity produced in the state is generated from coal, nuclear, hydroelectric, natural gas and petroleum. The first three fuel sources represent the vast majority of electricity resources used in the state. Natural gas and petroleum for the production of electricity are used primarily for smaller peaking units that generally operate in the summer.

Net generation of electricity in 1997 increased by 1,065 million kilowatthours from 1996 to 28,388 million kilowatthours. In 1997, electricity generation by fuel type was as follows: 60.6 percent from coal, 32.6 percent from nuclear and 5.8 percent from hydroelectric resources. The remaining one percent of electricity was produced from natural gas and petroleum.

According to the Energy Information Administration, Nebraskans' average price of electricity was 5.32 cents a killowatthour in 1996; for residential customers, the cost was 6.29 cents; for commercial customers, the cost was 5.49 cents; and for industrial customers, the cost was 3.68 cents.

National Trends

The electric industry in America continues to undergo some of the most fundamental changes the industry has ever seen. Among the most significant issues that continued to develop during the reporting period:

Other National Issues of Note

In quieter times in the industry, items and issues noted below might have commanded more attention:

|

Governor Mike Johanns |

|

On Restructuring in Nebraska "As the only state in the union with publicly owned electrical systems, our stakes in the current debate are high because today we Nebraskans enjoy both low cost and high dependability in our electrical suppliers. "That could change under the restructuring debate taking place in Washington, D.C." Editorial, Kearney

Hub, "Nebraska is at risk in a deregulated environment. It is the only state with[out] private power companies. All of its electric utilities are owned by the public or cooperatives. It is a rural state in which it is costly to deliver electricity to country customers. And electricity costs in Nebraska are below the national average. A Department of Agriculture survey said deregulation would increase the cost of electricity in 19 states, including Nebraska. "Those reasons are ample cause for Gov. Mike Johanns to make an appearance this week before the Senate Committee on Energy and Natural Resources to plead Nebraska's case. His testimony maintained the leadership Nebraska officials have shown on the issue. Former Gov. Ben Nelson helped found the Governors' Public Power Alliance to make sure public power interests were represented as the legislation was shaped." Editorial, Lincoln Journal

Star, "Public power, Nebraska's 53-year-old experiment in socialism, is an experiment no more. " It's a going concern, delivering an adequate and dependable supply of energy to the state's businesses and homes at economical rates. "The main question is whether Nebraska would be better off with private power or whether the rewards would outweigh the risks in abandoning a system that has worked well since the 1940s. "No leap into the unknown should be taken in this situation." Editorial, Midlands Business

Journal, "Recent price gouging and contract defaults for wholesale electricity ought to put a couple speed bumps in front of the headlong rush into further deregulation of the industry. "Is the wholesale market properly structured and regulated? The unprecedented and outrageous price gyrations this summer certainly raise questions. They should be answered before Congress moves to the next step of deregulating the retail market for electricity. That step should be taken only after the potential consequences are thoroughly explored." Editorial, Lincoln Journal

Star, |

Restructuring in Nebraska

In September 1999, the Legislature's task force studying the state's electric systems in light of changes in the industry released its long-awaited report on how state policymakers should respond to restructuring initiatives across the nation. The group's recommendation was for the state to identify market conditions that must be met before any consumer in Nebraska could change electric utilities.

The task force found that average rates in Nebraska are already 24 percent below the national average. Few on the task force thought many would benefit from opening the state's electric system to competition.

If adopted by the Legislature, competition would only be allowed in Nebraska when the wholesale cost of electricity surpassed average regional costs. The group also recommended the state's Power Review Board examine and propose the conditions triggering restructuring and how such a restructured industry would function.

During the legislative session in 2000, the Unicameral is expected to consider the recommendations.

Other issues in Nebraska

Other issues of importance in the electric industry happened in 1998-1999:

Nuclear Power and Nuclear Waste

Nuclear Power

State Production and Consumption

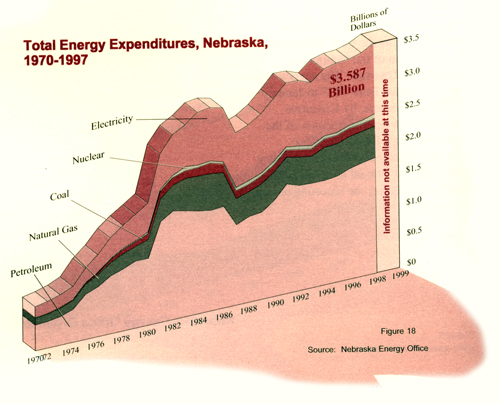

Nuclear generated electricity in the state in 1997 declined by two percent from 1996 levels. A total of 9,269 million kilowatthours were produced by the state's two nuclear generators in 1997, marginally down from the 9,457 million kilowatthours produced in 1996.

Nebraskans paid an estimated $58 million in 1997 for the nuclear generated electricity used in the state, up from $54 million in 1995.

About one-third of all electricity used in the state in 1997 came from nuclear power, little changed the 1996 level of 34.6 percent.

National Trends

While the United States has the greatest nuclear capacity in the world, future capacity is expected to decrease over the next decade. By 2010, America's nuclear capacity is projected to decline from 99 gigawatts to about 93 gigawatts as older units are deactivated according to the Energy Information Administration. A gigawatt is one million kilowatts. Premature closing of some nuclear units because of deregulation could accelerate this trend. The nuclear power industry has stalled in America because of three factors: high operating and construction costs relative to other fuel sources and unsolved nuclear waste disposal. No new nuclear power plants are planned.

|

Editorial, Omaha World-Herald, |

Nebraska Nuclear Facilities

The state has two nuclear power generating facilities - Fort Calhoun Nuclear Station operated by Omaha Public Power District and Cooper Nuclear Station near Brownville operated by Nebraska Public Power District. Fort Calhoun is one of the older commercial nuclear facilities still operating in the nation.

State Trends

No new nuclear facilities are planned for construction by utilities in the state due to cost inefficiencies and unsolved storage issues for low- and high-level waste.

In April 1998, the Omaha World Herald provided a detailed look at the state's nuclear power plants' past and future. In inflation-adjusted dollars, the construction of Fort Calhoun cost $650 million and Cooper $1.2 billion. Projections by the utilities have estimated decommissioning costs at $854 million and $819 million, respectively. Decommissioning fees are currently being collected from ratepayers and invested. The two utilities expect investment earnings to pay for half to two-thirds of the decommissioning costs.

Other state highlights during the reporting period:

Nuclear Waste

The majority of nuclear waste in the state is produced by the two nuclear power stations. For storage purposes, radioactive material is classified as high- or low-level waste depending on the length of time the waste remains radioactive.

High-level waste is spent nuclear fuel and has primarily been stored on site at the nuclear power plants awaiting construction of a temporary or permanent repository. Fort Calhoun has storage capacity until 2006. The Cooper station expects to exhaust on-site storage by 2004 or later.

Permanent High-Level Waste Storage

|

To finance the Yucca Mountain site, utilities with nuclear generators have been paying one-tenth of a cent per kilowatt-hour produced by the reactors.

Waste Isolation Pilot Plant

Construction on the furthest developed nuclear waste storage facility, the Waste Isolation Pilot Plant, was begun in 1983 near Carlsbad, New Mexico. Designed to store radioactive wastes resulting from the production of nuclear weapons, it also tests the use of prehistoric salt beds to entomb radioactive waste. The waste to be stored there will remain deadly for 240,000 years.

The $2 billion, 20-year project finally accepted the first waste shipment of 36 barrels in March 1999. Legal and other challenges had delayed the opening of the storage facility since 1989. Additional challenges to the plant remain unresolved. The U.S. Department of Energy claims one-quarter of the nation's population lives within 50 miles of military nuclear waste storage sites.

According to the original plans, 50 years of nuclear bomb wastes contained in 850,000 drums will be stored at the site which is expected to be permanently sealed in 2034. The salt caverns in which the drums are stored are located one half mile below the surface in the New Mexican desert.

Yucca Mountain

Since the selection of Yucca Mountain, the federal energy agency responsible for site development has faced both technical problems and political opposition.

According to Nuclear Regulatory Commission data, by 2003, 31 of the nation's 110 operating nuclear power plants will be unable to completely remove their fuel supply from the reactor and store it elsewhere on the site. As a result of this growing situation, dry cask storage - spent nuclear fuel rods stored in 361 19-foot-tall steel-lined cement silos - are now part of the landscape at 19 plants.

In December 1999, the project reached a milestone when - after 15 years of research and spending $6 billion - the site's viability assessment was completed. The study, which raised as many questions as it answered, found "no show stoppers" that would block further development of the site. The agency remains on schedule to make a formal recommendation to the President on the selection of the site by 2001.

Other details about the project were revealed in the viability assessment:

Since 1995, Congress has attempted to make the selection of Yucca Mountain permanent. However, opposition by the Nevada congressional delegation, as well as others, has prevented this from happening. For the past several years, at least one house of Congress has approved the legislation. However, both houses of Congress have been unable to agree to compromise legislation that could withstand a Presidential veto.

In 1997, the Department of Energy lost a court case filed by 42 utilities and 35 public agencies since the federal agency had not taken possession of the waste as called for in the Nuclear Waste Policy Act of 1982. Since the federal agency had no place to store the waste, the agency proposed to the court that the waste be stored on site at the power plants. The courts were considering whether the federal energy agency would be responsible for paying the costs incurred by the utilities.

Monitored Retrievable Storage

Temporary storage of spent nuclear fuel was also listed as a possibility in the 1982 law if a permanent facility was not operational by 1998. According to the Edison Electric Institute, an estimated 36 nuclear plants will exhaust their on-site storage of radioactive waste by 2007, including the two plants in Nebraska.

Action during the reporting period on this type of storage focused on two storage options: a government-operated facility located at Yucca Mountain and a privately operated facility on Native American tribal lands in Utah.

The Skull Valley Band of Goshutes in Utah hope to develop a temporary storage site for nuclear wastes on their land which is about 50 miles from Salt Lake City.

The tribe, which has formed a joint venture with eight utilities, plans to develop a $1.5 billion facility containing 4,000 15-foot high concrete silos on 840 acres. Fifty-year leases for waste storage have already been signed by the utilities. Under current plans, the facility would open in 2002, if licensed by the Nuclear Regulatory Commission. The Commission expects to hold hearings on the project in late 1999, but has already approved similar, but much smaller, types of projects near reactors.

Utah state government has been taking a number of actions to stop the project, fearing that temporary storage could easily become permanent storage:

Transporting Nuclear Waste

Whether high-level waste is civilian or military, it must be moved from where it was produced to temporary or permanent storage sites. Because many nuclear facilities are east of Nebraska and likely storage areas are west of the state, rail lines and highways in Nebraska are probable corridors for shipments of radioactive waste.

One nuclear group estimated 92,000 shipments would be needed over the next 30 years to move the waste from generators to storage sites.

Depending on the method of transportation - rail or truck - an estimated 62 to 82 percent of the shipments will cross the state. These shipments are expected to begin when the permanent nuclear waste storage site opens in 2010.

Typically, only one or two shipments of radioactive waste traverse the state monthly, according to the State Patrol. However, 125 shipments of foreign waste began moving across the state in 1999. These shipments of foreign waste should conclude in 2000.

Permanent Low-Level Waste Storage

Until 1999, Nebraska belonged to one of nine regional or state compacts in the nation formed to develop storage facilities for low-level radioactive waste. Low-level waste is generally composed of clothing, filters, resins, tools and other items from nuclear power plants and hospitals. According to the U.S. Department of Energy, utilities generate more than 50 percent of the low-level waste. In Nebraska, it is estimated that utilities generate 90 percent of the low-level waste. Low-level waste remains radioactive for 90 days to 200 years, according to experts.

"It's time for

Congress to take responsibility for the disposal of low-level nuclear

waste. "It's been 18

years since Congress passed the law that pushed the issue down to the

states. It hasn't worked, and there's no reason to believe it will in the

future. "Not a single

low-level waste dump has been built. "So far, the multi-state compact to

which Nebraska belongs has spent more than $90 million. "For what?"

Editorial, Lincoln Journal

Star "Proposals for

waste facilities in California and Texas had appeared near approval. Now,

however, the federal government has refused to turn over land for the

proposed facility in California. The state of Texas denied a license for

the proposed site there. "Hundreds of

millions of dollars have been spent since Congress in 1980 set up the

system that was supposed to lead to the creation of nuclear waste

facilities. "None has ever

been built. "It's time for

Congress to recognize the reality that no regional facilities will ever be

built. It needs to readdress the issue of how the nation should dispose of

its low-level nuclear waste." Editorial, Lincoln Journal

Star

Boyd

County Radioactive Waste Storage Facility and Related Issues

On Boyd County, Nebraska Proposed Site

August 9, 1998

December 23, 1998

Boyd County, Nebraska, was selected as the location for a low-level radioactive waste facility in 1988 by the regional compact, the Central Interstate Low-Level Radioactive Waste Commission, and the developer, U.S. Ecology. Over the past 11 years, $90 million was spent analyzing the license application submitted to the state of Nebraska by the Compact and the proposed operator.

In August 1998, Nebraska preliminarily ruled that no license would be issued to operate a storage facility in Boyd County. The state Department of Environmental Quality said the permit would be denied for several reasons including: sufficient depth to the water table, groundwater discharges, lack of a buffer zone, deficiencies that would lead to monitoring beyond the 30-year life of the facility and financial stability of the contractor. In December 1998, the state reaffirmed its earlier intention and denied the application to operate a low-level nuclear waste storage facility in the state.

The state then proceeded to hold public hearings. As a result of the intent to deny the license, the contractor modified the site proposal and improved its financial status. The Compact also has the option of appealing the state decision through administrative hearings or turning to the courts. The Compact Commission and the proposed operator also planned to appeal the state's decision administratively and through the courts. In March 1999, a temporary restraining order was issued by the court barring the state from proceeding with an administrative review of the appeal filed by the utilities and the Compact Commission.

At the end of 1998, some of the utilities which had financed the $91 million licensing process filed suit against the state of Nebraska, the Central Compact and the proposed operator, U.S. Ecology. Omaha Public Power District joined the lawsuit while Nebraska Public Power District opted not to join. In April 1999, a federal judge said there was "strong evidence" the state acted in bad faith by rejecting the license application for a low-level waste facility. The judge also barred the state from further action on the denial process. Experts close to the issue said if the state loses the court case it could incur a $7.5 million liability.

In January 1999, the state legislature received a legal opinion that there would be only "minimal" financial liability from withdrawing from the Central Low-Level Waste Compact Commission. Under the Commission's rules, the withdrawal process takes five years. However, the Department of Environmental Quality estimated the state could expend $9 million in lawsuits related to the denial of the application.

In March 1999, the Commission and its proposed operator closed both offices in the state and planned to end funding after spending $94.5 million on the Nebraska project.

In the 1999 session of the legislature, the body considered a bill to withdraw from the Central Compact Commission. At the end of the reporting period, final action had not been taken by the Legislature.

Until a regional facility is operational, the two Nebraska utilities store waste on site or send the waste to a facility in Barnwell, South Carolina. The South Carolina facility is expected to remain open for six or seven years. However, the landfill's operator warned in 1997 that shipments to the site were declining to a level that may require the facility to close ahead of schedule due to unfavorable economic conditions. At various times over the years, South Carolina's officials have vacillated on how long the facility will continue to accept waste from other states. For example, a December 1998 recommendation by a South Carolina group called for closing the facility to all out-of-state shipments.

Nationally, the two other low-level waste facilities that were progressing toward development in California and Texas went off track as well. In California, the federal land the state had selected for site development was removed from consideration when the Department of Interior reversed a decision to transfer the land to the state of California.

State Consumption and Expenditures

After peaking in 1973 at more than 230 trillion British thermal units, Nebraska's natural gas consumption has plummeted by more than half to 131.9 trillion British thermal units in 1997. Natural gas expenditures in the state totaled an estimated $507 million in 1995, still below the peak of $567 million in 1984, and an increase of 1.4 percent from 1994.

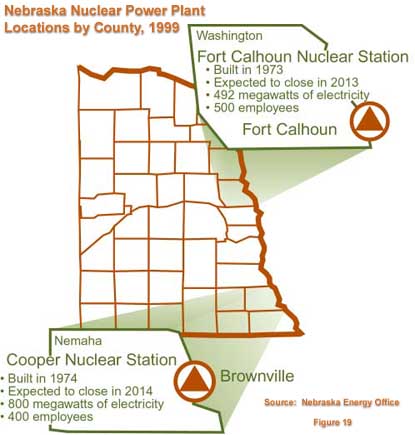

State Production

A small amount of natural gas is mined in the state - less than one percent of that used in a year. A production surge that began in 1993, peaked in 1994 and declined in subsequent years. Natural gas production totaled 1.214 billion cubic feet in 1998, slightly up from the 1.14 billion cubic feet in 1997. The all-time production low in Nebraska was in 1991 when 784 million cubic feet were mined. Most of the state's production is confined to seven counties in the Panhandle as shown in figure 21. More than 82 percent of all natural gas production in the state in 1998 came from Cheyenne County. Without any new natural gas field discoveries, the state's production levels should gradually decline over time. Given those prospects, nearly 100 percent of the state's natural gas needs in the future will come from imports.

National Trends

|

Order 636 fundamentally changed the natural gas utility industry. Securing supplies of natural gas became the responsibility of local utilities, with pipelines reverting to a common carrier status. The effect of the "unbundling" of services forced utilities to deal with every leg of the fuel's travel, from well-head to the customer's door. In the past, utilities relied on a regulated system to guarantee an adequate supply for their customers. With the regulatory safety nets stripped away, utilities must purchase the right amount of gas for the right customers. The new system will also cause a shift in costs according to the Wall Street Journal. Individual homeowners and small businesses will pay more, while big industrial customers will be able to negotiate for lower costs.

By the end of 1999, the American Gas Association projected one-third, or 18.1 million customers of the 54 million households with natural gas service, will be able to choose their gas supplier. The Association estimated about 40 percent of small commercial customers had the option to select their natural gas supplier.

Earlier in the year, Congress' General Accounting Office found that 43 natural gas utilities in 16 states offered retail and small commercial customers a choice of gas from different suppliers. A survey conducted by the Office estimated only 500,000 of the eligible 18 million customers had actually changed from their traditional natural gas supplier.

Neither of these studies was able to quantify savings realized by the customers, in part, because so many of the choice efforts were too new. However, the Nebraska-based PACE reported on average, its customers would save 12 percent on residential gas bills during the first year.

One of the survey findings illustrated a downside to natural gas supply choices: in several cases, no alternatives could be found for the traditional supplier.

The Government Accounting Office study did heap praise on a Nebraska choice effort by KN Energy. The utility had the highest response rate in the nation - 70 percent - of any utility choice effort. An estimated 57,000 Nebraskans actively selected from among several natural gas supplier options. Nearly a quarter of the customers opted for a supplier different than their traditional one, also one of the highest rates in the nation. KN Energy allows its customers to select a new natural gas supplier every year.

State Trends

The ramifications of Federal Energy Regulatory Commission Order 636 continued to resonate throughout the state. The state's largest users of natural gas have always been able to secure the gas they need from sources other than local providers.

Customer groups such as motels, restaurants or schools and local government groups are finding that by using a third party to secure natural gas supplies, they can save from five to 17 percent on their natural gas bills. For the first time, these smaller commercial operations are reaping the benefits that previously only larger firms could realize.

Even a number of smaller cities - Auburn, Fairbury and Wahoo - have become a "customer group" capable of supplying natural gas to larger users within their jurisdictions. This form of service is called "aggregation."

Aggregation of natural gas customers enveloped a group of residential customers in Dakota City and South Sioux City. In December 1996, both towns became aggregators for all the customers in their respective towns, purchasing natural gas from the Nebraska Public Gas Agency and not the local supplier, Mid America Energy. According to the Nebraska Natural Gas Agency, 32 towns in the state have become aggregators.

Another facet of deregulation, choice of natural gas suppliers for small users, was offered by KN Energy in 1998 to most of the utility's customers.

A different choice option was offered by the other major utility serving Nebraska. Peoples Natural Gas gave customers price options, not supplier options. The options included: fixed price, capped index, weather guaranteed and traditional portfolio. Most customers opted for the traditional portfolio.

Other Issues of Note

A number of other natural gas issues surfaced in the state and nation during the reporting period:

|

State Production and Consumption

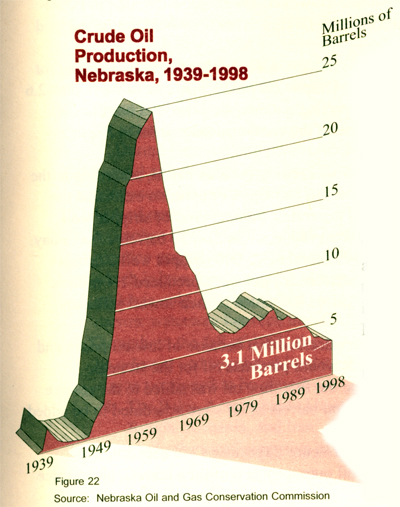

Oil production in 1998 in the state dropped for the ninth consecutive year. The 3.17 million barrels pumped represented a 4.9 percent drop from 1997 and a new modern-day low. Figure 22 illustrates the state's oil production history since 1939.

The last time oil production was this low was 1952, when the state's first oil well was just a teenager. Only 1,800 barrels were pumped in 1939, the year of the first oil strike in the state. By 1952, production had risen to 2.68 million barrels. None of the oil mined in the state has been refined in Nebraska since the last refinery closed in the 1980s.

Oil is produced in only 17 of the state's 93 counties and two counties, Hitchcock and Kimball, produced almost half of all the oil pumped in 1998. Figure 23 indicates the oil-producing counties in Nebraska.

It appears even the use of advanced oil recovery technology, where practical, will not reverse the state's oil production decline.

An estimated 44.1 million barrels of oil were consumed in the state in 1997, up 1.6 percent from the year before. About seven percent of the oil used was produced in the state. As a result, more and more of the state's petroleum needs are being met by other states and countries.

National Trends

The state's oil dependence is a more extreme example of the nation's dependence: Nebraska's domestic oil production satisfies about seven percent of its' needs while about 46 percent of the nation's oil needs are satisfied by oil produced within the 50 states. Both the state and the nation are increasingly dependent on others to satisfy their needs for petroleum and products refined from it.

Long-term trends indicate the nation will remain dependent, especially in the critical transportation sector, for years into the future. While the transportation sector is critically dependent on petroleum, overall the nation has dramatically cut its petroleum dependence in other sectors of the economy. According to economists, energy accounted for 8.7 percent of every dollar of gross domestic product in the late 1970s, but by the late 1990s, energy accounted for only three percent.

During the reporting period, several earlier events continued to unfold while several others emerged as issues to follow into the future:

|

State Trends

As noted earlier in this section, Nebraska oil production suffered during the precipitous drop in oil prices in 1998. Unlike oil production in other regions, Nebraska's oil producers face a series of obstacles to profitability: oil fields in the state are located much deeper and smaller than other regions of the nation and the world; the wells are more mature and produce smaller amounts of oil; and transportation costs to refineries are high. The state's prolonged decline in oil production is documented in figure 22.

According to former Nebraska oil workers, the state's oil wells have never been highly profitable. A $10 barrel of oil in Nebraska is generally considered break-even in terms of profitability. In July 1998, a barrel of Nebraska oil was selling for as little as $8 a barrel.

According to the state's Oil and Gas Conservation Commission, Nebraska's oil industry was once valued at $300 million annually. Today, the yearly earnings amount to one-sixth of that.

With the decline in prices, well drillings have also plummeted. The Commission estimated that 1998 drillings might decline by 90 percent. Low prices also induced many companies to abandon and plug unprofitable wells. In 1999, the Unicameral passed legislation to create a trust fund to pay for the plugging and closing of abandoned wells. Each well that has been inactive for two or more years will be assessed a $200 fee to finance closure of these wells.

The State Gas Tax Board also raised the variable portion of the gas tax in June 1999 from 23 to 24.1 cents a gallon. Nebraska's gasoline tax when ranked in comparison with other states moved from 14th to ninth after the increase became effective July 1, 1999.

Other Issues of Note

During the reporting period, other petroleum issues also arose:

Efforts to develop clean, abundant and affordable alternatives to the use of fossil fuels have been aided by five factors - technological improvements, increasingly stringent environmental laws, federal research funding, utility regulators and broad-based public support. Because Nebraska is a public power state, utility regulators are not considered a factor in fostering the growth of alternate energy forms in the state. The five main alternate energy sources - biomass, geothermal, hydropower, solar and wind - are detailed in this section.

State Production and Consumption

In 1997, the Energy Information Administration estimated hydropower supplied 2.7 percent of the total energy consumed in the state which was only marginally less than the percentage of energy supplied by hydropower in 1996. Biomass, including ethanol, supplied less than one percent of the energy used in Nebraska in 1997. The Energy Information Administration estimates in 1997, all five forms of alternate energy supplied less than four percent of the energy used that year. Energy production from alternate energy sources is increasing but very, very slowly, and is increasingly being outstripped by the overall growth in energy use.

National Trends

According to the Energy Information Administration's Renewable Energy Annual for 1998, renewable sources of energy accounted for eight percent of the nation's total energy needs in 1997, the most recent year available.

Hydropower and biomass continued to dominate the renewable energy category with 55 percent and 38 percent shares, respectively. Geothermal, wind and solar contribute the remaining seven percent of the renewable resources used in the nation. In 1997, the largest growth in renewables occurred in the transportation sector, which increased 31 percent over the previous year because of increased use of ethanol in motor fuels.

In the Administration's Annual Energy Outlook 2000, federal prognosticators stated wind energy could multiply its contribution to the U.S. electric supply almost 18 times to 36 gigawatts by the year 2020, if the federal government adopts renewable portfolio standards without caps or expiration dates.

As electric restructuring policy decisions are made at the state and federal levels, the growth or stagnation of renewables in the nation's power mix will largely be determined.

State Trends

As indicated above in "State Consumption and Production," alternate energy production and use have remained fairly constant over the years, despite the state's overall growth in energy consumption.

In the near term, only marginal growth in alternate energy resources is foreseen. Increases are likely in biomass-to-ethanol production, wind-to-electricity production and solar photovoltaic utilization. These trends are expected to continue into the future unless renewable energy production is adopted as part of restructuring of the electric industry. In that case, growth in energy from alternate sources could increase dramatically.

Fuel Source Types

Biomass

|

"Relicensing of Kingsley Dam may not stir ...much reader interest. It results from a unique approach to resolving very complicated issues. When you get the political leaders of three states, environmentalists, irrigators, other water users and a collection of federal and state agencies to agree on a solution to anything you know you have accomplished something miraculous." Editorial, North Platte Telegraph |

Biofuels - ethanol/gasoline blends and soy/diesel blends - represented potential growth areas for the state's quest for value-added industries as well as methods of reducing its reliance on oil imports, especially in the petroleum dependent transportation sector. The greatest potential for near-term growth in ethanol production and use could come from the reduction and elimination of methyl tertiary butyl ether, or MTBE, in gasoline. MTBE has become a major water pollutant where the gasoline additive has been used extensively.

During the reporting period, the first out-of-the-lab, commercially-sized efforts began to utilize valueless crop waste and other cellulose materials in lieu of grain to produce ethanol. One such experiment was being conducted at the High Plains ethanol plant in York. The plant will mix corn stover - leaves, stalks and corn cobs - with corn to produce ethanol. A federal grant of $193,000 from the U.S. Department of Energy is financing the endeavor.

Throughout the reporting period, the state continued its commitment to increase the use of 85 percent ethanol/15 percent gasoline blends, called E85.

In January 1999, the federal Department of Energy released data showing that E85 is the nation's fastest growing alternate fuel, growing at a rate 11 times faster than its nearest competitor. Two publicly-accessible pumps opened in the state in 1998.

For the second year, University of Nebraska-Lincoln engineering students participated in a national competition, the 1999 Ethanol Vehicle Challenge, where trucks were modified to operate on 85 percent ethanol fuel blends.

Geothermal

Geothermal energy use in Nebraska remains limited to small-scale systems such as ground-source heat pumps used in schools, businesses and homes.

Hydropower

Hydropower in the state comes from two sources - 11 hydroelectric dams in or on the border of the state and power supplied to Nebraska by Western Area Power Administration. The Power Administration transfers hydroelectric power produced in western states to state agencies, municipalities and public power districts. Taken together, all hydroelectric sources met about 15 percent of the state's electricity needs in 1997. Nationally, the Energy Information Administration says only four percent of the nation's energy needs were satisfied from hydroelectric sources in 1997.

In 1997, Western Area Power Administration provided 2.814 million megawatthours to municipally-owned systems, rural districts, state agencies and regional public power districts. A megawatthour is one million watthours of power. The value of the hydroelectricity was $50.3 million.

At this time, it is not anticipated that other sources having hydroelectric potential will be developed in the state. It is more likely that hydro resources will decline with time.

The major hydro event during the reporting period was the end of the 14-year effort to relicense the Kingsley Hydroelectric Dam. In July 1998, the Federal Energy Regulatory Commission issued at 40-year license for the dam which was originally constructed in the late 1930s. The relicensing effort cost Nebraska Public Power District and Central Nebraska Public Power and Irrigation District an estimated $36 million.

Solar

Solar or photovoltaic energy continued to make significant technological gains in reducing the cost of electricity from this power source. In 1996, three American solar panel production facilities came on line and six more plants are scheduled to begin operation in 1997.

Electricity produced from solar power is expected to cost 12 cents per kilowatt. Currently costs are estimated at 18 cents a kilowatt, down from $2 a kilowatt in 1976.

The worldwide market for solar is greater outside economically developed countries, especially where infrastructure is non-existent. An estimated one-third to one-half of the world's population currently lives without electricity. In 1995, solar power worldwide grew 18 percent and is expected to grow annually by 20 percent through 2000, according to industry sources.

Nationally, less than one percent of the electricity used comes from solar sources. However, use of solar technology in other areas of the world is expanding dramatically. Between 1992 and 1996, the United States more than doubled the production of solar cells and modules to 36 megawatts. The vast majority of these products are exported to European, Asian and Third World countries.

The key to advancing solar technology remains moving from a one-of-a-kind prototype to mass production. When solar cells are mass produced, the cost of production plummets. For example, if the technology used in the prototype tests could be mass produced, it has been estimated that electricity from the solar cells could be produced for 5.5 to 6 cents per kilowatt, including one cent for maintenance. However, this is still above current Nebraska electricity production costs, but well below the national average price of eight cents per kilowatt.

Current, cost-effective use of solar cell technology in Nebraska is primarily limited to the powering of electric fences by cattle producers. However, solar water pumping technology - both installed and portable - is becoming more available.

Solar photovoltaic arrays are currently being used by state government at one interstate reststop and on several highway information signs.

Northwest Rural Public Power District, based in Hay Springs, has conducted practical consumer-based photovoltaic research since 1991. The utility has found solar panels used for water pumping to be cost competitive in certain settings, especially when more than 325 feet of electrical lines need to be constructed. Solar panels have also been used to replace broken windmills. According to utility personnel, more than 1,000 windmills are still in use by customers. The District leases the solar panels to customers for a period of one year, charging only the cost of the system, not for the power generated by the solar panels. The District leases more photovoltaic systems per customer than any other utility company in America.

Wind

|

Editorial,

Lincoln Journal Star |

According to the Worldwatch Institute, three European countries far outpaced the United States in producing electricity from wind in 1997:

A megawatt is one thousand kilowatts. One megawatt is about the right amount of power to meet the peak demand of a large hotel or about 720 homes daily needs.

The U.S. Department of Energy estimated wind energy production at 1,600 megawatts in 1998, reaching 2,500 megawatts by mid-1999. Commercially-scaled wind farms are planned or under construction in Iowa, Minnesota, Wyoming and Texas.

A research company, Allied Business Intelligence, reported in late 1999 that global wind power surpassed 10 gigawatts which is enough electricity to fulfill energy needs in five million homes.

Despite dramatic growth in the number of U.S. wind turbines, the Energy Information Administration in the Renewable Energy Annual 1998 reported a decline of wind energy production in 1997 from the previous year. The Administration found wind capacity had declined by 57 megawatts because retirement of aging machines outpaced new turbine construction.

The federal energy agency estimated the price of a kilowatthour from wind at five cents. To be economically viable with other fuels used in electric generation, wind energy costs need to fall to two to two-and-a-half cents.

In June 1999, the U.S. Department of Energy announced a plan to produce five percent of the nation's electricity from wind by 2020, up from the current one-tenth of one percent. The department also proposed having the federal government rely on wind resources for five percent of its electricity needs by 2010.

In June 1999, the results of a four-year study of wind potential at eight Nebraska sites were released. The study found wind speeds across the state are strong enough to support a large-scale commercial wind farm. The average annual speeds ranged from 13.9 to 16.8 miles per hour. Generally, wind speeds are highest in western Nebraska, and lowest in the east. July and August tended to produce the lowest average wind speeds. This is usually when Nebraska's electric utilities reach their peak needs for power. The $336,000 study was paid for by several of the state's utilities, including federal grants received by the Energy Office.

In October 1998, the state's first two commercial wind turbines came to life in Springview in north central Nebraska. The $2.1 million project is being undertaken by six utilities: Nebraska Public Power District, KBR Rural Public Power District, Lincoln Electric System, Municipal Energy Agency of Nebraska, and the cities of Grand Island and Auburn. Half the cost of the turbines is coming from a federal grant. The two turbines will generate enough power for 350 homes, or 750 kilowatts. The turbines are the largest produced in the United States. Because of a technical problem, the turbines were shut down in November to eliminate a humming problem on local telephone lines. By December, the problems had been resolved and the turbines were again producing electricity.

In December 1998, Lincoln Electric System's wind turbine north of the capital city began generating electricity. The $1 million turbine's cost is being underwritten by about 2,000 utility customers who have agreed to pay an extra $4.30 a month for several years. The power from the turbine should meet the needs of 175 houses. In April 1999, the utility decided there was enough customer support to construct a second wind turbine. Power from the new turbine is expected in November.